Streamlining Business Operations: The Role of Payroll Software

Introduction to Payroll Software

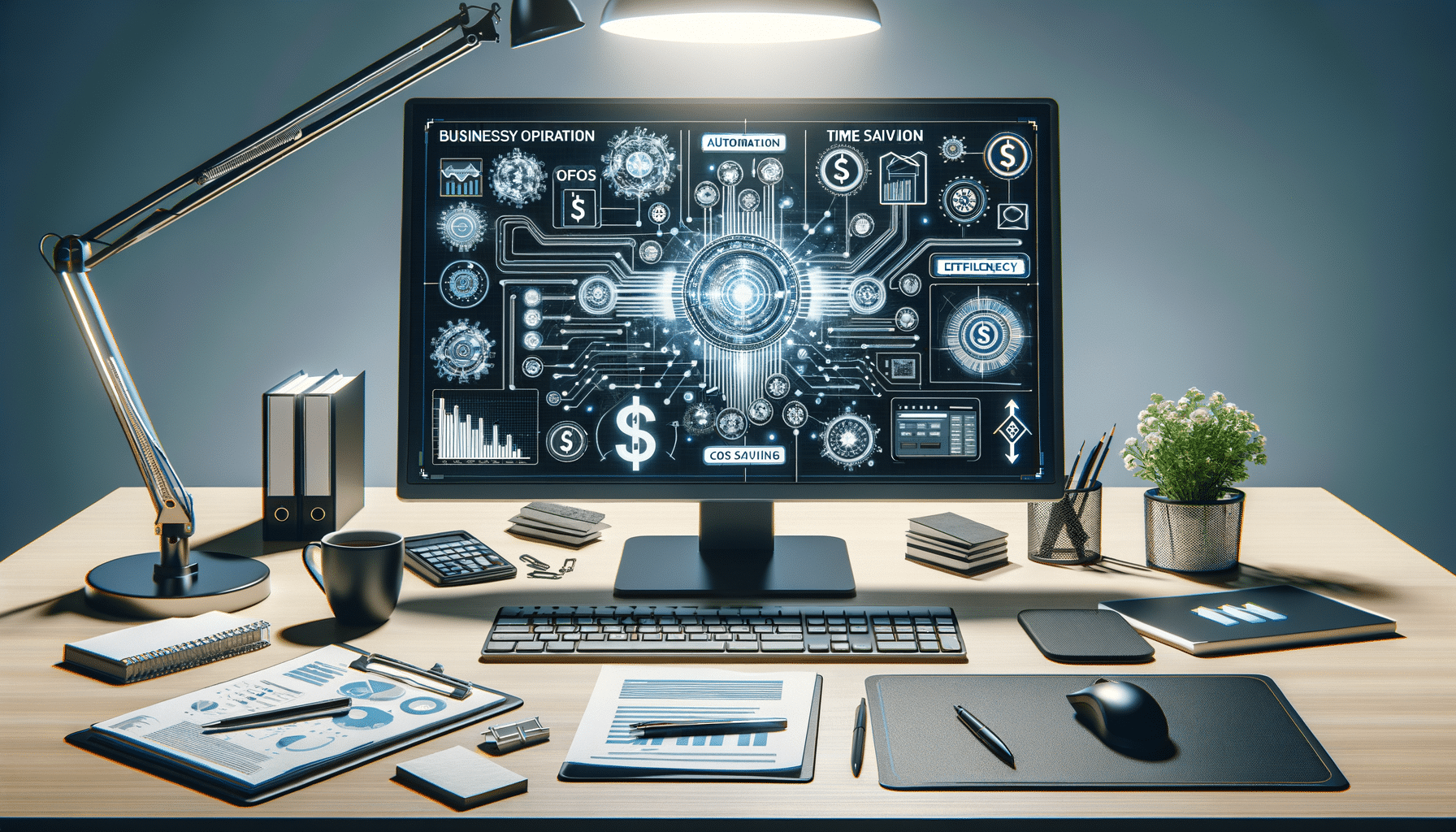

In the ever-evolving landscape of business operations, payroll software has emerged as a crucial tool for managing employee compensation efficiently. As companies grow and expand, the complexities of payroll management increase exponentially. Payroll software simplifies these processes, ensuring that businesses can focus on their core activities while maintaining regulatory compliance and accuracy in financial transactions.

Payroll software automates the calculation of employee salaries, tax deductions, and other financial obligations, reducing the risk of human error. This technology not only saves time but also enhances the accuracy of payroll processing, which is vital for maintaining employee satisfaction and trust. By streamlining payroll operations, businesses can allocate resources more effectively and improve overall productivity.

Key Features of Payroll Software

Payroll software offers a wide array of features designed to meet the diverse needs of businesses. One of the primary functions is the automation of payroll calculations, which includes computing wages, overtime, bonuses, and deductions. This automation ensures that employees are paid accurately and on time, fostering a positive work environment.

Another significant feature is tax management, where the software automatically calculates and withholds the appropriate taxes based on current regulations. This capability helps businesses remain compliant with tax laws, reducing the risk of costly penalties. Additionally, payroll software often includes reporting tools that provide valuable insights into labor costs and financial planning.

Many payroll solutions also offer integration capabilities, allowing seamless communication with other business systems such as accounting and human resources. This integration ensures data consistency across platforms, enhancing operational efficiency. Furthermore, employee self-service portals are commonly included, enabling staff to access their pay stubs, tax forms, and personal information, reducing administrative workload.

Benefits of Implementing Payroll Software

Implementing payroll software offers numerous benefits that extend beyond simple payroll processing. One of the most significant advantages is the reduction in administrative workload, allowing HR and finance teams to focus on strategic initiatives rather than manual data entry. This shift can lead to increased productivity and improved business outcomes.

Payroll software also enhances compliance with labor laws and tax regulations. By automating these processes, businesses can ensure that they are adhering to legal requirements, minimizing the risk of audits and penalties. Additionally, the accuracy of payroll calculations is improved, reducing the likelihood of costly errors and fostering trust among employees.

Another benefit is the ability to generate detailed reports and analytics, providing insights into workforce costs and trends. These insights can inform decision-making and strategic planning, ultimately driving business growth. Furthermore, payroll software can improve employee satisfaction by ensuring timely and accurate payments, contributing to a positive organizational culture.

Choosing the Right Payroll Software

Selecting the right payroll software for your business involves evaluating several factors to ensure it meets your specific needs. First, consider the size of your organization and the complexity of your payroll processes. Larger businesses with intricate payroll requirements may need more robust solutions with advanced features, while smaller companies might benefit from simpler, cost-effective options.

Another important consideration is the software’s integration capabilities. Ensure that the payroll solution can seamlessly connect with your existing systems, such as accounting and HR platforms, to maintain data consistency and streamline operations. Additionally, assess the software’s user interface and ease of use, as a complex system may require extensive training and reduce efficiency.

Customer support and vendor reputation are also crucial factors. Choose a provider with a strong track record of customer service and positive reviews, as this can significantly impact your experience with the software. Lastly, consider the scalability of the solution, ensuring it can grow with your business and adapt to changing needs over time.

Future Trends in Payroll Software

The payroll software industry is continuously evolving, with new trends and technologies shaping its future. One such trend is the increasing use of artificial intelligence (AI) and machine learning to enhance payroll processes. These technologies can improve accuracy, automate complex tasks, and provide predictive analytics, offering valuable insights for decision-makers.

Another emerging trend is the shift towards cloud-based solutions, which offer greater flexibility and accessibility compared to traditional on-premise software. Cloud payroll systems enable remote access, allowing businesses to manage payroll from anywhere with an internet connection. This capability is particularly valuable in the current landscape, where remote work is becoming more prevalent.

Additionally, there is a growing focus on employee experience, with payroll software providers enhancing self-service features and mobile accessibility. These improvements empower employees to manage their financial information independently, reducing administrative burden and increasing satisfaction. As technology continues to advance, payroll software will likely become even more integral to business operations, driving efficiency and innovation.